Green Flash Brewing has had a rough year. First, it was announced that they were shutting down and liquidating their Virginia Beach brewery, along with pulling out of distribution in 32 states and laying off more than 40 employees. Then, last week, they shut down their Cellar 3 tasting room and barrel aging program. This week, it was announced that Green Flash has been sold to a private equity firm after Comerica Bank, their largest shareholder, foreclosed on its loans because of high outstanding debt and poor health of the business, selling its assets in a foreclosure sale.

While there are differing opinions on why Green Flash has fallen on hard times, the U-T reported that a former brewer said much of the issues have to do with “expanding to the East Coast before its West Coast brewery had reached peak production; moving from six-packs to costlier four-packs; and tinkering with the recipe of its flagship ale, West Coast IPA.”

The West Coaster reached out to Mike Hinkley, the founder of Green Flash and this is what he said:

“Green Flash continues on and so does Alpine. The beer is being brewed, packaged and delivered to retailers today. The tasting rooms are open for business. It is true that the companies have new ownership and that the company has refocused on being local and regional, versus national. And it is also true that the investments of its previous owners, including myself, are now gone. I am very, very sorry about that.

“I am trying to focus on the positives. Green Flash and Alpine, and all of the folks that brew the beer, prepare the food, drive the forklifts, wait the tables, tend the bars, and work in sales, marketing and accounting all have jobs today. Good paying jobs with real healthcare coverage. That was not a sure thing, not too long ago. I worked very hard to get this transaction accomplished with them in mind.

“I apologize to Pat and Val McIlhenney because this is not how they or I would ever have wished things would turn out. I am glad they took the most of their money out of the company by now. I wish they would have gotten it all out. I wish things turned out exactly as they hoped when they sold Alpine Beer Company four years ago.

“I also apologize to the rest of the GFBC, Inc. shareholders who lost their investments. I was the largest cash investor, never sold a share and continually reinvested. I suppose it is appropriate that I lost all of my investment and I will come to grips with that. But it will be much harder for me to get over other people losing their investments.

“I am very optimistic about the future of Green Flash and Alpine who emerge from very challenging times with a stable financial position and streamlined operations. The breweries will continue to make amazing beer and enjoy them with their fans.”

What About Alpine?

One major question that was flying around the San Diego craft beer community was, “What’s going to happen to Alpine?” Alpine Beer Co. joined forces/was acquired by Green Flash in 2014 in what was predicted by both parties to become a long and happy marriage. Green Flash was excited about brewing Alpine’s beers (and having such a prolific brewery name in their stable) and Alpine was excited that there were going to finally be able to start to meet the demand that they had created by brewing awesome beers for years on their tiny brew-system. That marriage came to an unhappy end when Pat Mcllhenney, the founder of Alpine, posted this on Facebook:

Pat was also quoted in a Union-Tribune article saying, “I don’t have a lot of faith in the management,” he said, “especially if they keep Mike on management. He has no business being in this business. His business prowess is abysmal.” Consider this beer-couple divorced.

Jacob Nikos, from YEW podcast, sat down with Pat recently and discussed all of this. It’s a great listen and really gives a solid perspective on the San Diego beer as well as the Green Flash/Alpine relationship.

The San Diego craft beer community is rallying behind the employees of both Green Flash and Alpine. After all, the Green Flash is an integral part of the West Coast IPA’s rise in popularity over the last 15 years. Alpine is loved even more, with a stellar reputation for their beers and their influence over the San Diego craft beer scene.

Who Are the New Owners?

The private equity firm that bought them does have one interesting connection. Joshua Yelsey, the new manager of the equity firm hails from Anheuser-Busch. There, he was a manager in AB’s mergers and acquisitions department. Additionally, he was head of finance for Goose Island and Blue Point during both acquisitions. The question is, how close are his ties to his old company? Will he just bring experience to his new role or will he bring contacts for future acquisitions of a certain San Diego beer darling with an impressive beer portfolio? That would truly be a sad day for independent SD beer.

People in the SD craft beer community are pretty salty over the whole situation. While this acquisition is preferable to both breweries shutting down and leaving hundreds of people out of job, the issue is about the close ties that people have to their friends and colleagues who had invested their time and money into Alpine and Green Flash. Who, because of the foreclosure, have lost all the money they had in the companies, including the founders of Alpine.

Down But Not Out

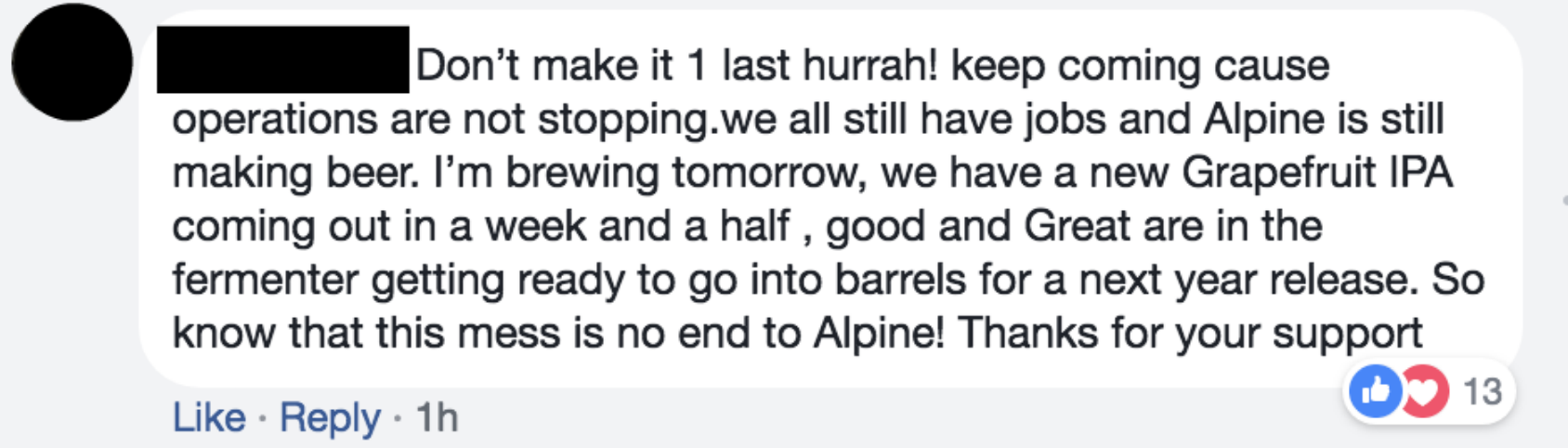

The biggest takeaway should be that these breweries might be facing some big changes but they are still open, brewing beer and working hard to create a tasty beverage for consumers. When someone posted on an SD craft beer message board that they were heading to Alpine this week for a “last hurrah,” one of the brewers posted this:

We are pulling for both Alpine and Green Flash. It certainly is a hard pill to swallow that so many San Diegans who invested in both companies have now lost their investments, but the employees from both breweries are working hard to continue their path in San Diego craft beer and we fully support them in this next chapter of their brew-story.

How involved is InBev? Is InBev involved at all?

Even before I read about the InBev connection I assumed that the equity firm would cut as many expenses as they can, try to make the breweries profitable, or at least more valuable, and then sell them to a macrobrewer. Equity firms have one goal and that’s making money. Not optimistic about this situation.